Insurance call center agents are increasingly struggling to sell policies to customers, reflecting broader challenges within the industry. Traditionally, call centers have been essential in providing support and driving sales for insurers. However, the current context is making it difficult for agents to effectively engage with policyholders and close sales.

One major issue is the widespread talent shortage affecting the industry. This talent gap means that call centers are often staffed by agents who lack the necessary expertise and experience to confidently sell policies, leading to lower conversion rates. Additionally, maintaining in-house call centers has become a significant financial burden for insurers.

To attract and retain the limited talent available, insurers must offer competitive salaries, further straining profitability. On top of that, the costs and long times associated with training and coaching an entire workforce for these operations add to the challenge, making it harder for insurers to sustain effective sales teams.

Turning to AI As a Solution

Automating training and coaching for insurance call center agents can significantly improve their performance by allowing them to practice in realistic scenarios without the actual risk of handling live calls prematurely. While technology has often been used to automate routine tasks and process large data sets, its true potential lies in preparing agents to deliver the empathetic, personalized support that policyholders expect.

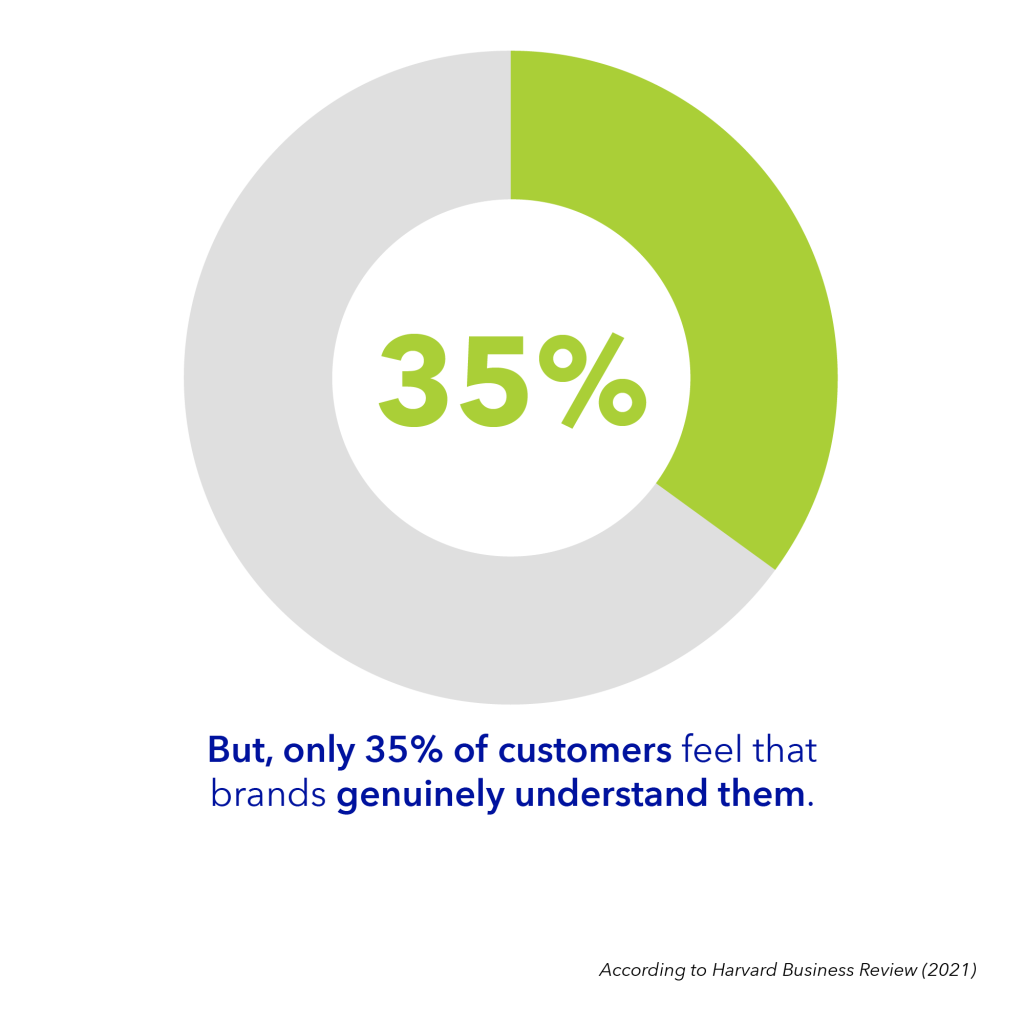

Besides the challenges related to selling, insurance interactions are often driven by stressful situations, whether it’s filing a claim after a loss or trying to reduce premiums due to financial concerns. In these moments, policyholders are seeking more than just information; they want reassurance from a knowledgeable, empathetic agent who understands their specific needs and can offer tailored solutions.

Traditional training methods may not fully equip agents with the skills needed to handle these complex, emotionally charged conversations, or to have what they need to leverage selling or upselling opportunities when they arise. However, automated coaching systems can create a risk-free environment where agents can practice these scenarios repeatedly, receiving instant feedback and guidance. This hands-on, realistic training enables agents to refine their approach, ensuring they’re well-prepared to manage real calls with confidence and sensitivity.

By simulating various sales scenarios, such as pitching a new policy, suggesting additional coverage, or overcoming objections during upsell attempts, agents can build the skills needed to identify customer needs and present the right solutions at the right time. This continuous, adaptive training ensures that agents not only provide empathetic support but also effectively drive new sales and maximize revenue opportunities.

AI Coaching Policyholder Sales

Leveraging AI coaching to enhance selling and upselling skills among insurance call center agents presents a transformative opportunity for improving new policy sales. As a business leader tasked with assessing and implementing AI solutions, the focus should be on creating a long-term strategy that uses AI as a powerful companion tool. By integrating AI coaching into sales training programs, agents can develop and refine critical sales skills in a simulated environment, which can lead to substantial improvements in real-world performance.

AI coaching platforms allow agents to engage in realistic, risk-free simulations that mimic complex sales scenarios they might encounter with actual policyholders. These simulations can be tailored to various sales situations, such as pitching a new policy, cross-selling additional coverage, or handling objections during upselling attempts. Through repeated practice in these AI-driven environments, agents can hone their sales techniques, learn to identify subtle cues, and master the art of persuasion, all without the pressure of being in a live call.

The key advantage of using AI coaching is its ability to provide personalized, instant feedback to agents. This continuous feedback loop enables agents to quickly identify areas for improvement, adjust their approach, and reinforce successful strategies. Over time, agents can develop a deep understanding of customer needs and how to address them effectively, leading to higher conversion rates and more successful upselling.

Ultimately, AI coaching is not just about improving individual agent performance, it’s about creating a scalable solution that enhances your entire sales operation. By investing in AI-driven coaching, you can build a more skilled, effective sales force that drives growth, increases policyholder satisfaction, and strengthens your company’s competitive position in the market.